If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

A $50 penalty is assessed on each report filed after the due date.An out-of-state entity, ending its nexus in Texas, must file its final report and pay any amount due within 60 days of ceasing to have nexus.A Texas entity, terminating, converting or merging, must file its final tax report and pay any amount due in the year it plans to terminate, convert or merge.

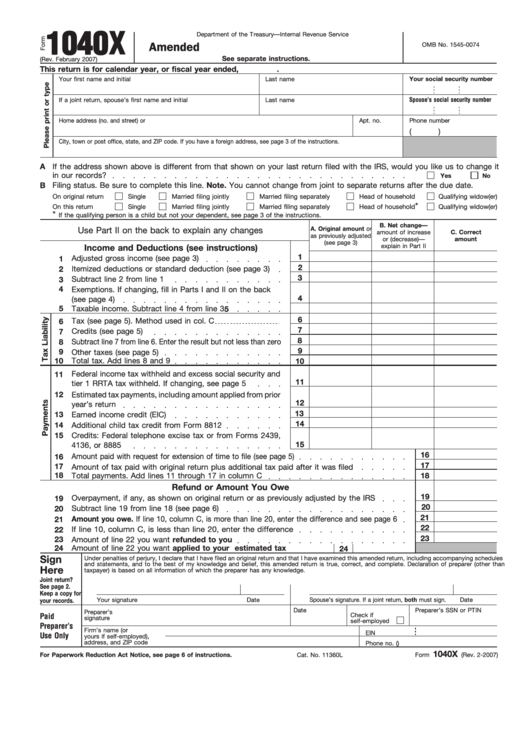

#Irs amended return status registration#

If May 15 falls on a weekend or holiday, the due date will be the next business day.īefore getting a Certificate of Account Status to terminate, convert, merge or withdraw registration with the Texas Secretary of State: The annual franchise tax report is due May 15. Tax Rates, Thresholds and Deduction Limits for Prior Years 20 Item Tax Rate (other than retail or wholesale) Use the rate that corresponds to the year for which you are filing. Tax Rates, Thresholds and Deduction Limitsįranchise tax rates, thresholds and deduction limits vary by report year.

0 kommentar(er)

0 kommentar(er)